Many critics continue to claim that the Pakistan Super League is poorly managed and drifting in the wrong direction. Social media has recently amplified these claims, particularly through outspoken posts by Ali Tareen, which have sparked debate among fans and analysts alike. While some of his arguments may resonate with the public, a closer look at the league’s operations tells a very different story. From what I understand about the PSL’s internal workings, much of the criticism is exaggerated. Yes, there is always room for improvement in governance and structure, but despite its flaws, the PSL remains the most valuable and profitable product of Pakistan cricket, generating billions of rupees annually for the Pakistan Cricket Board (PCB).

Before the latest reassessment of franchise values, every team except Multan Sultans had already agreed to renew their contracts. This decision came even before the substantial hike in franchise fees was announced. The fact that none of these owners withdrew afterward clearly demonstrates that PSL ownership is far from a loss-making venture. If the league were truly in financial trouble, franchises would not commit to higher long-term investments.

Multan Sultans, however, appeared uncomfortable with the revised franchise valuation. It seems likely that their ownership group believed they could walk away from the existing agreement and re-enter the auction to acquire a new team at a lower cost. Bid documents were even requested under the name of Daharki Sugar Mills, suggesting serious intent. Yet, in a dramatic turn, they pulled out minutes before the auction began. In business terms, this amounted to spending $20,000 on participation fees without gaining anything in return. Perhaps by that point, they had realized that franchise prices were set to skyrocket and that their previous record fee of 1.08 billion rupees would soon be eclipsed.

That prediction proved accurate.

As I had written in my previous column, there was a strong possibility that bids could approach the two-billion-rupee mark—and they almost did. Several participants clearly underestimated the appetite of serious investors. Some appeared to be there merely for visibility, while others assumed bidding would stall at a few hundred million. The PSL once again shattered those outdated assumptions and demonstrated its growing commercial strength.

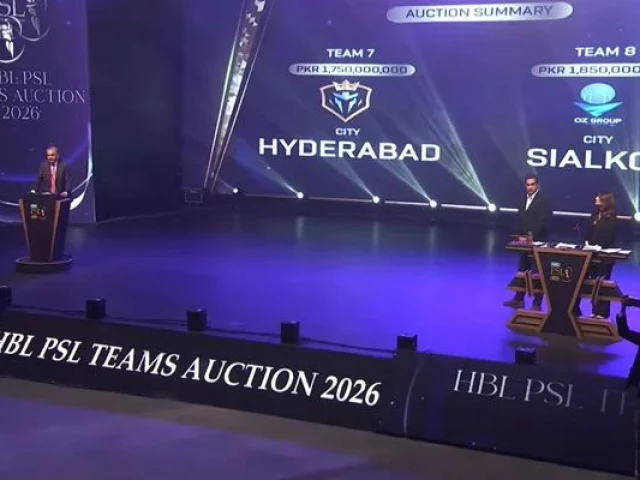

One group that always looked determined was FKS (Kingsmen). Even before the auction, there were indications that Hyderabad had been shortlisted with their interest in mind. Their bidding behavior left little doubt that they were fully committed to securing a franchise. Had circumstances required it, they likely would have crossed the two-billion threshold without hesitation.

After the first team was sold for an impressive 1.75 billion rupees, the PCB made a smart and strategic move by raising the reserve price for the next franchise. This effectively ended any hopes of bargain purchases and ensured that only serious bidders remained in contention.

Another notable entry came from the Ozi Group. While I don’t personally know Hamza Majeed, I have known his partner Kamil Khan for years and can confidently say he is an energetic and forward-thinking businessman. Their determination paid off when they secured a franchise for a record-breaking 1.85 billion rupees, later naming the team Sialkot.

Interestingly, both newly awarded franchises went to overseas investors—one group based in the United States and the other in Australia. This international interest further strengthens the PSL’s credibility as a global sporting product.

Meanwhile, several other bidders remained passive, placing token bids or simply observing proceedings. Many of them likely assumed the reserve price would not even be met. In the end, they paid over 5.6 million rupees just to participate, gaining nothing more than fleeting visibility. At best, they could tell friends and family that they appeared on television during the auction.

Although I was invited by the PCB to attend the auction in person, unavoidable reasons kept me away, and I watched the entire process live on television. The event was professionally hosted by Wasim Akram, who handled proceedings with his usual charisma. It was also encouraging to see Lahore Qalandars owner Atif Rana present at the press conference, representing continuity and respect for long-term stakeholders. Ideally, all existing franchise owners should have been invited as special guests and acknowledged for their contributions to building the league from scratch.

Nonetheless, the transparency and efficiency of the auction deserve genuine praise. PCB Chairman Mohsin Naqvi, Salman Naseer, and their team executed the process flawlessly. The live broadcast ensured complete openness, every bidder received equal opportunity, and those who had tried to stir controversy were denied the spotlight they sought. This alone reflected mature and confident leadership.

Looking ahead, the PSL now stands at a crucial growth phase. Franchise fees are paid directly to the PCB rather than the central revenue pool, meaning the board must now aggressively pursue larger commercial partnerships. With more teams and matches, media rights are expected to become even more lucrative. However, future contracts must also guarantee timely payments to maintain financial stability.

The addition of two new franchises significantly raises operating costs. While the PCB has committed to distributing at least 850 million rupees per franchise from the central pool over five years, teams will still need to invest heavily from their own resources. Annual operational expenses could range between 900 million and one billion rupees, with another 500–600 million allocated to player salaries, logistics, and administrative costs. Covering roughly 1.5 billion rupees per year is no small task, but investors of this caliber rarely commit funds without a well-defined financial roadmap.

Player retention rules are another major point of debate. New franchises favor zero retention to ensure competitive balance, while existing teams want to retain up to five players. A compromise—perhaps allowing three retained players—appears to be the most practical solution. Completely eliminating retention would unfairly penalize older franchises that have invested years in squad development.

While it is natural for the PCB to show enthusiasm toward new, high-paying franchises, it must also respect and protect the interests of long-standing owners who supported the league when it was still an untested concept.

All stakeholders now share a collective responsibility to elevate the PSL into an even stronger global brand. Reports suggest that Multan Sultans may soon be sold again, a move that could potentially exceed two billion rupees given current market trends.

For now, credit must be given where it is due. Mohsin Naqvi and his team have delivered another major success, reinforcing the PSL’s position as a thriving, transparent, and commercially powerful league. For more in-depth cricket business analysis and PSL updates, visit netsports247.com.